does texas have an inheritance tax 2019

Texas has no income tax and it doesnt tax estates either. Currently twelve states have estate taxes with some exemptions being as low as 1 million.

Top 10 Pure Tax Havens Best Citizenships

Like the inheritance tax you need to be aware of the laws of states in which you have real property as you could have exposure to that states estate tax.

. The exemption will increase to 1140 million in 2019. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. The state of Texas is not one of these states.

In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025. Near the end of the interview procedure TurboTax stated. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death.

The state repealed the inheritance tax beginning on 9115. FEDERAL ESTATE TAX RATES Taxable Estate Base Taxes Paid Marginal Rate Rate Threshold 1 10000 0 18 1 10000 20000 1800 20 10000 20000 40000 3800 22 20000 40000. The 1041 federal return was for the estate of my father who died in the middle of 2018.

His assets were held in a living trust that became an irrevocable trust upon his death. The state business return is not available in TurboTax. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Some states have inheritance tax some have estate tax some have both some have none at all. The due date is the same as the federal due date 9 months after the date of death. Whether they will have to pay the tax and how much they will have to pay depends on how closely they were related to.

In Texas the median property tax rate is 1692 per 100000 of assessed. Though Oklahoma has no estate tax the federal estate tax will apply to Sooner State residents with large enough estates. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to.

In addition six states have inheritance taxes. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is also no inheritance tax in Texas.

The sales tax is 625 at the state level and local taxes can be added on. However this is only levied against estates worth more than 117 million. So only very large estates would ever need to worry about this tax becoming an issue.

Tax was permanently repealed effective as of September 15 2015 when Chapter 211 of the Texas Tax Code was repealed. You are required to file a state business income tax return in. There is a 40 percent federal tax however on estates over 534 million in value.

Texas also imposes a cigarette tax a gas tax and a hotel tax. The federal government does not impose an inheritance tax so the recent tax changes from the Trump administration did not affect the inheritance taxes imposed by the states. The IRS did however change the federal estate tax exemption from 2018 to 2019 from 1118 million to 114 million.

Tennessee had a separate inheritance tax which was phased out as of January 1 2016. Its inheritance tax was repealed in 2015. The federal estate tax has an exemption of 1118 million for 2018.

Delaware repealed its estate tax in 2018. What are the estate tax rates in Texas. Maryland whose nickname is the Free State has both.

Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. Prior to September 15 2015 the tax was tied to the federal state death tax credit. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive.

See where your state shows up on the board. As of 2019 only twelve states collect an inheritance tax. This exemption is portable meaning that one spouse can pass their exemption to the other.

However other states inheritance taxes may apply to you if a loved one who lives in those states gives you money so make sure to check that states laws. Georgia does not have an estate tax form. Finding Information About Taxes On Interest An initial gift of money or property is tax-free but if.

You must file a copy of the federal return with payment for the Georgia tax. The state of Texas does not have an inheritance tax. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million.

Nebraska is one of a handful of states that collects an inheritance tax. If you are a Nebraska resident or if you own real estate or other tangible property in Nebraska the people who inherit your property might have to pay a tax on the amount that they inherit. Theres no personal property tax except on property used for business purposes.

The federal government of the United States does have an estate tax. If no Federal estate tax return is required to be filed no Georgia filing is required. Tax is tied to federal state death tax credit.

There are no inheritance or estate taxes in Texas. The federal government does not have an inheritance tax. New Jersey finished phasing out its estate tax last year and now only imposes an inheritance tax.

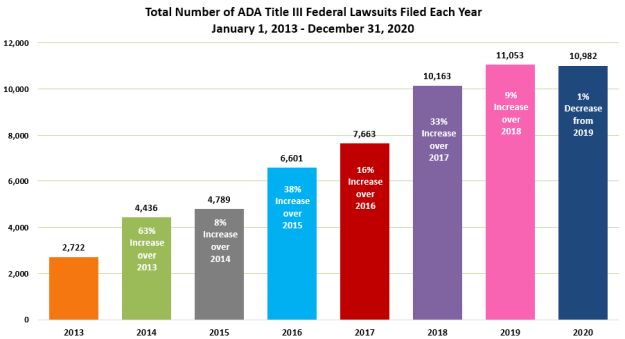

The Pandemic Slowed 2020 Federal Ada Title Iii Filings But 2021 May Be A Record Breaker Employment And Hr United States

Average Retirement Savings By State Personal Capital

Bonhams Yoshitomo Nara Japanese Born 1960 Marching On A Butterbur Leaf Offset Lithographic Poster Printed In Colours 2019 On Wove From The Edition Of 1000 Published By Dallas Contemporary Texas The

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Demanding An Accounting From An Executor Texas Probate Litigation

International Tax Lawyers Houston Texas Http Bit Ly 2gic5ik Tax Lawyer Tax Attorney Creative Thinking Skills

Brooke Tackett Client Solutions Manager Robert Half Linkedin

Where S My State Refund Track Your Refund In Every State

Estate And Gift Tax Planning Wolters Kluwer

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What Is A Life Estate Deed And How Does It Work Downs Law Firm P C

Gift And Estate Tax Laws No Changes From Congress After All

Texas Munis 2021 Growth Against The Caution Light The Texas Lawbook

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Estate Taxation Texas A M Agrilife Extension Service